Scopri i marchi delle nostre divisioni: Adhesive Technologies e Consumer Brands.

21 feb 2019 Düsseldorf / Germany

Henkel achieves good organic sales growth with strong earnings, profitability and cash flow

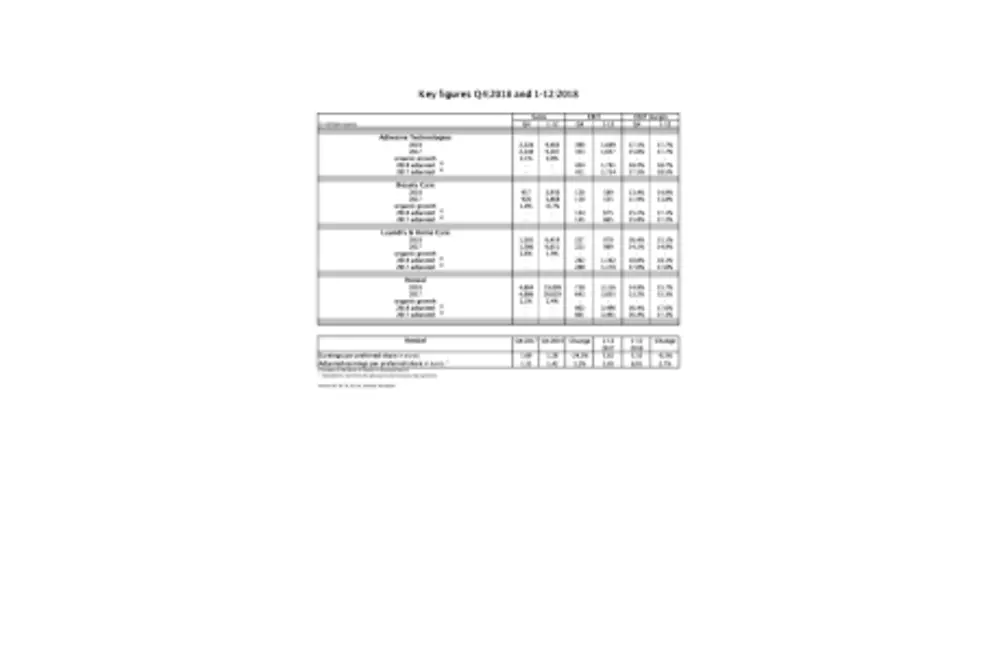

- Sales at 19.9 billion euros: impacted by negative currency effects of 1.1 billion euros; organic growth +2.4%

- Increase in operating profit (EBIT)1: +1.0% to 3,496 million euros

- Further EBIT margin1 improvement: +30 basis points to 17.6%

- Earnings per preferred share (EPS)1: +2.7% to 6.01 euros, at constant exchange rates +7%

- Strong expansion of free cash flow: +12.7% to 1,917 million euros

- Record dividend2 payout: +3.4% to 1.85 euros per preferred share

- Very good progress in implementation of strategic priorities

- Growth initiatives underline commitment to profitable growth

“In 2018, we continued to deliver profitable growth for Henkel. We achieved good organic growth with new highs in earnings and profitability. We also significantly increased free cash flow. At the same time, we faced substantial negative currency effects as well as increasing direct material prices. The overall good business performance was once again driven by our successful brands and innovative technologies with leading positions in highly attractive markets and categories. Our profitable growth was complemented by the contributions from acquisitions in our industrial and consumer goods businesses. We maintained our strong cost discipline and continuously improved our efficiency,”said Henkel CEO Hans Van Bylen.

“We made substantial progress in the execution of our strategic priorities through to 2020 and beyond. We successfully implemented key strategic initiatives and further improved our competitiveness. To capture additional growth opportunities, mainly in our consumer goods businesses, and to further accelerate the digital transformation of our company, we announced in January to step up investments by around 300 million euros annually from 2019 onwards,” said Hans Van Bylen. “Our mid- to long-term financial ambition underlines our commitment to delivering sustainable profitable growth and attractive returns.”

Outlook 2019

Reflecting the increased growth investments from 2019 onwards, Henkel expects an organic sales growth of between 2 and 4 percent in the current fiscal year. For the adjusted EBIT margin, Henkel expects a range of 16 to 17 percent and an adjusted EPS development in the mid-single percentage range below prior year at constant exchange rates.

Sales and earnings performance 2018

Nominally, sales in the fiscal year 2018 decreased slightly by 0.6 percent to 19,899 million euros. Currency developments had an overall negative effect of around 1.1 billion euros or -5.4 percent on sales. Adjusted for foreign exchange effects, sales grew by 4.8 percent. Acquisitions and divestments accounted for 2.4 percent of sales growth. Organic sales, which exclude the impact of foreign exchange effects and acquisitions/divestments, showed a good increase of 2.4 percent.

The Adhesive Technologies business unit delivered strong organic sales growth of 4.0 percent. Organically, sales in the Beauty Care business unit were 0.7 percent below prior year. The Laundry & Home Care business unit reported a good increase in organic sales of 1.9 percent.

The emerging markets again posted a very strong increase in organic sales of 6.3 percent. The mature markets registered a slightly negative organic sales performance of -0.4 percent.

Sales increased organically in all regions, apart from North America. In Western Europe, sales showed a positive organic development of 0.3 percent. In Eastern Europe, sales grew organically by 7.6 percent. Africa/Middle East posted organic sales growth of 11.3 percent. Sales in North America were organically 1.0 percent below the level of the prior year. This development was due to the delivery difficulties in Henkel’s North American consumer goods businesses at the beginning of the year 2018. The Adhesive Technologies business delivered a strong performance and the Professional Hair Care business showed significant growth in this region. Latin America achieved organic sales growth of 9.3 percent, and in the Asia-Pacific region, sales grew organically by 0.9 percent.

Adjusted operating profit (EBIT) improved by 1.0 percent to 3,496 million euros, a new high for Henkel.

Adjusted return on sales (EBIT) rose by 0.3 percentage points to 17.6 percent. This is also a new high for the company.

The financial result amounted to -65 million euros after -67 million euros3 in fiscal 2017.

Adjusted net income for the year after non-controlling interests increased by 2.8 percent to 2,604 million euros (2017: 2,534 million euros).

Adjusted earnings per preferred share (EPS) grew by 2.7 percent from 5.85 euros to 6.01 euros. At constant exchange rates, EPS growth reached 7 percent.

The Management Board, Supervisory Board and Shareholders’ Committee will propose to the Annual General Meeting on April 8, 2019 an increase in the dividend per preferred share of 3.4 percent to 1.85 euros (previous year: 1.79 euros). The proposed dividend per ordinary share is 1.83 euros, an increase of 3.4 percent compared to the previous year (1.77 euros). This would be the highest dividend payment in the company’s history and equals a payout ratio of 30.9 percent.

Net working capital as a percentage of sales reached 5.1 percent, showing good improvement in the course of the year, especially in the second half, nearly matching the level of the prior-year period (4.8 percent).

The net financial position closed the year at -2,895 million euros (December 31, 2017: -3,222 million euros3). The change compared to the end of the previous year was primarily due to the strong free cash flow development.

Business unit performance

The Adhesive Technologies business unit generated strong organic sales growth of 4.0 percent in fiscal 2018. In nominal terms, sales grew by 0.2 percent to 9,403 million euros. Adjusted operating profit increased by 1.6 percent to 1,761 million euros. Adjusted return on sales grew by 0.2 percentage points, reaching 18.7 percent.

Organic sales development in the Beauty Care business unit was slightly negative at -0.7 percent in fiscal 2018. Nominally, sales grew by 2.1 percent to 3,950 million euros. Adjusted operating profit grew by 1.6 percent to 675 million euros. Adjusted return on sales was slightly below the level of the prior year, reaching 17.1 percent.

The Laundry & Home Care business unit generated good organic sales growth of 1.9 percent in fiscal 2018. Nominally, sales reached 6,419 million euros after 6,651 million euros in the prior year. Adjusted operating profit decreased slightly by 0.7 percent to 1,162 million euros. Adjusted return on sales grew strongly by 0.5 percentage points and reached 18.1 percent.

Very good progress in strategy implementation in 2018

“We pursue a clear long-term strategy for Henkel: We want to generate sustainable profitable growth. With Henkel 2020+, we defined our four strategic priorities for 2020 and beyond: drive growth, accelerate digitalization, increase agility and fund growth. Over the past two years, we have made very good progress and successfully implemented key strategic initiatives,” said Hans Van Bylen.

In 2018, Henkel continued to execute a range of projects and initiatives to further drive growth in its markets around the world. Regular in-depth exchange as well as close collaboration with customers in Henkel’s industrial and consumer businesses were key success factors.

A particular focus was placed on accelerating the innovation cycles and the reduction of innovation lead times to address new market trends and customer needs faster. Henkel made good progress in improving its innovation processes, resulting in high innovation rates as well as increasing first-year sales from innovations or from top ten innovations.

Henkel also made further progress in the integration of acquired businesses and completed several new acquisitions that will strengthen competitiveness and complement the portfolio in the industrial and consumer businesses.

To capture new sources of growth, Henkel’s Corporate Venture Capital unit continued to invest in new technologies, materials, applications, business and service models with direct investments in start-ups as well as in other venture funds. Henkel has planned to invest about 150 million euros in venturing activities between 2017 and 2020. By the end of 2018, around half of this amount was already invested or committed.

Henkel made good progress in the digital transformation of the company. In 2018, digital sales at Group level increased organically with double-digit growth rates, driven by organic growth of more than 30 percent in our consumer goods businesses. Henkel invested further in its production facilities in order to leverage the potential of Industry 4.0. This allows an optimized steering of production sites and processes, resulting in higher quality, improved efficiency and more sustainability.

A Digital Advisory Board with renowned industry experts was set up to advise the Management Board on the digital transformation process.

Henkel X was launched as an internal and external platform to accelerate the digital transformation of Henkel. In order to support and consult its employees working on digital projects and initiatives, Henkel also established a unique mentorship network of around 150 external mentors that include founders, digital experts and thought-leaders. This was complemented by a broad range of internal and external activities to further advance the digital capabilities and upskilling of the whole organization.

Digital transformation connects to Henkel’s strategic priority to increase agility across the entire organization. In 2018, Henkel continued to foster the entrepreneurial spirit of its employees and teams, encouraged openness to change, optimized workflows, supported more transparent communication and aimed at further expanding individual room for decision-making.

As part of its strategic priority to fund growth, Henkel continued to focus on cost discipline and efficiency. In this context, the company pursues four initiatives. In 2018, Henkel successfully rolled out its ONE!ViEW and Net Revenue Management initiatives across the company, while Henkel’s integrated global supply chain organization (ONE!GSC) as well as the ongoing optimization of the shared service activities continued to contribute to efficiency improvements. Combined, these initiatives are expected to deliver more than 500 million euros in annual efficiency gains as of 2020. In 2018, Henkel has already realized more than 50 percent of the targeted total efficiency gains.

Committed to long-term sustainable profitable growth

“2018 was a good year for Henkel. Despite significant currency headwinds and rising direct material prices, we achieved good organic sales growth, with strong earnings, profitability and cash flow. We made very good progress in implementing our strategic priorities and further improved our competitiveness. We are convinced that Henkel is well-positioned for the future. We have a clear strategy and pursue ambitious targets. With our increased investments in brands, technologies, innovations and digitalization, we are emphasizing our commitment to deliver sustainable profitable growth,” summarized Hans Van Bylen.

This information contains forward-looking statements which are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. Statements with respect to the future are characterized by the use of words such as “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, and similar terms. Such statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update any forward-looking statements.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.

1 Adjusted for one-time charges/gains and restructuring charges

2 Proposal to shareholders for the Annual General Meeting on April 8, 2019

3 Prior-year figures amended (mainly due to a change in accounting policies according to IFRS)